ontario ca sales tax calculator

91758 91761 91762 91764 91798. Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below.

How To Create An Income Tax Calculator In Excel Youtube

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

. The Ontario California general sales tax rate is 6. Employment income and taxable benefits. The minimum combined 2022 sales tax rate for Ontario California is.

This is very simple HST calculator for Ontario province. Ontario CA Sales Tax Rate The current total local sales tax rate in Ontario CA is 7750. The County sales tax rate is.

14 rows GSTHST calculator Use this calculator to find out the amount of tax that applies to sales in Canada. Use our simple 2021 tax calculator to quickly estimate your federal and provincial taxes. The vehicles wholesale value is greater than your purchase price so that value will be used for calculating your sales tax.

California has a 6 statewide sales tax rate but also has 513 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2492 on top. In general these are dividends received from public companies. Call the CRA at 1-855-330-3305 to order a copy.

Wayfair Inc affect California. For tax rates in other cities see California sales taxes by city and county. HST stands for Harmonized Sales Tax.

It is essentially the General Sales Tax and a Provincial Sales Tax rolled into one. The Ontario Basic Personal Amount was 10783 in 2020. Enter price without HST HST value and price including HST will be calculated.

The December 2020 total local sales tax rate was also 7750. 2021 Income Tax Calculator Ontario. 100 13 HST 113 total.

15000 13 1950 You will have to pay a 1950 CAD RST when you register the vehicle at a ServiceOntario center. Type of supply learn about what supplies are taxable or not. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services.

The second tax bracket at 915 is increasing to an upper range of 90287 from the previous 89482. California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. No change on the HST rate as been made for Ontario in 2021.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. You do not pay the tax to the person or entity that sold you the vehicle.

This is the total of state county and city sales tax rates. Ontarios indexing factor for 2021 is 09. Income Tax Calculator Ontario 2021.

The total amount of your capital gains. The Ontario Annual Tax Calculator is updated for the 202122 tax year. You can print a 775 sales tax table here.

The amount of taxable income that applies to the first tax bracket at 505 is increasing from 44740 to 45142. Discover Ontario Ca Sales Tax Rate for getting more useful information about real estate apartment mortgages near you. Ontario is in the following zip codes.

175 lower than the maximum sales tax in CA The 775 sales tax rate in Ontario consists of 6 California state sales tax 025 San Bernardino County sales tax and 15 Special tax. Calculating sales tax in Ontario is easy. Business professional commission partnership fishing and farming income.

The California sales tax rate is currently. Depending on the zipcode the sales tax rate of Ontario may vary from 65. It combines the payments of 3 tax credits into 1 payment.

Personal tax calculator. ON479 allows you to claim the. Ontario Political Contribution Tax Credit.

Ensure that the Find Subtotal before tax tab is selected. 2022 - Includes all rate changes announced up to January 15 2022. OR Enter HST value and get HST inclusive and HST exclusive prices.

The Ontario Trillium Benefit helps people pay for energy costs and provides relief for sales and property tax. For further information about eligibility or the terms used in the calculator please see our Frequently Asked Questions here. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Ontario CA.

Current HST rate for Ontario in 2021. For help please contact Tax Credits phone duty. OR Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price.

Tax credit estimates prepared by Ontario Creates may vary from those of the calculator based on information contained in a tax credit application. How 2021 Q1 Sales taxes are calculated in Ontario. Did South Dakota v.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple annual Ontario tax calculator or switch to the advanced Ontario annual tax calculator to review NIS payments and income tax. The HST for Ontario is calculated from Ontario rate 8 and Canada rate 5 for a total of 13. The rate you will charge depends on different factors see.

View and order forms at canadacataxes-general-package. Sales tax in Ontario Here is an example of how Ontario applies sales tax. Calculate the tax savings your RRSP contribution generates.

To calculate the subtotal amount and sales taxes from a total. To access tax credits and benefits when filing a paper tax return complete and submit these three forms with your tax return. Calculate your combined federal and provincial tax bill in each province and territory.

Province of Sale Select the province where the product buyer is located. Look up the current sales and use tax rate by address. HST tax calculation or the Harmonized Sales Tax calculator of 2022 including GST Canadian government and provincial sales tax PST for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador.

The Ontario sales tax rate is. There is no applicable city tax. Canadian corporate tax rates for active business income.

Any input field can be used. GSTHST provincial rates table The following table provides the GST and HST provincial rates since July 1 2010. This rate is the same since july 1st 2010.

Ontario applies 13 HST to most purchases meaning a 13 total sales tax rate. Sales Tax Breakdown Ontario Details Ontario CA is in San Bernardino County. Affordable Housing and Homelessness Prevention Programs.

Reverse Sales Tax Calculator 100 Free Calculators Io

Calculate Harmonized Sales Tax With This Free Online Hst Calculator For Any Canadian Province Where Hst Is Imp In 2021 Home Based Business Canadian Provinces Sales Tax

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Cannabis Taxes At Your Dispensary

Ontario Income Tax Calculator Calculatorscanada Ca

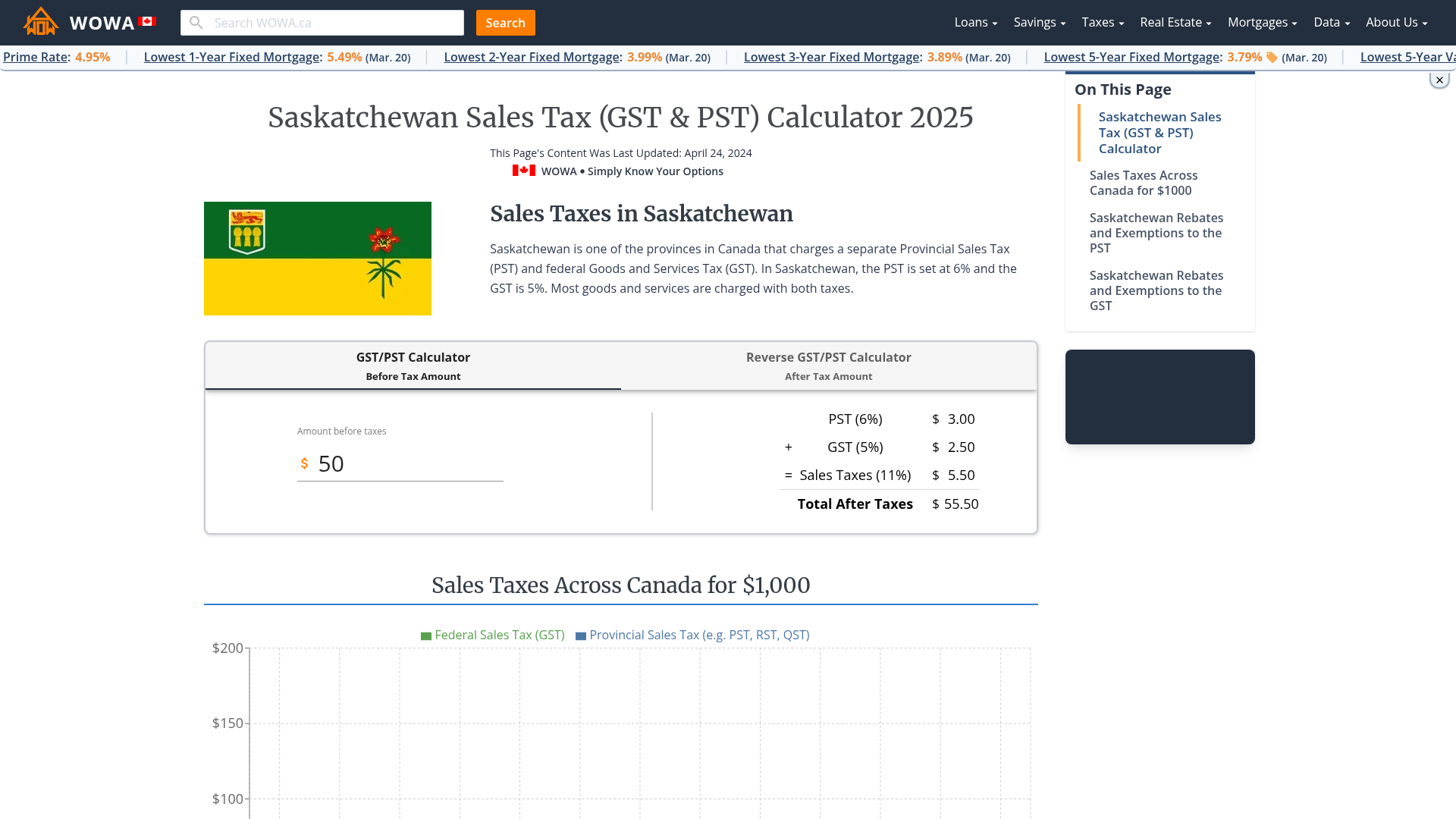

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax Video Lesson Transcript Study Com

How To Calculate Sales Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Sales Tax In Excel

Provision For Income Tax Definition Formula Calculation Examples

Gst Calculator Goods And Services Tax Calculation

How To Calculate Income Tax In Excel